If you are expecting to sell your home for an emotional premium, then here is what you need to do first.

You need to know the unemotional price range of your home before you start your sales campaign.

Skipping this step is a sure fire way for the wheels to fall off the wagon.

Knowledge is power.

Knowledge is money.

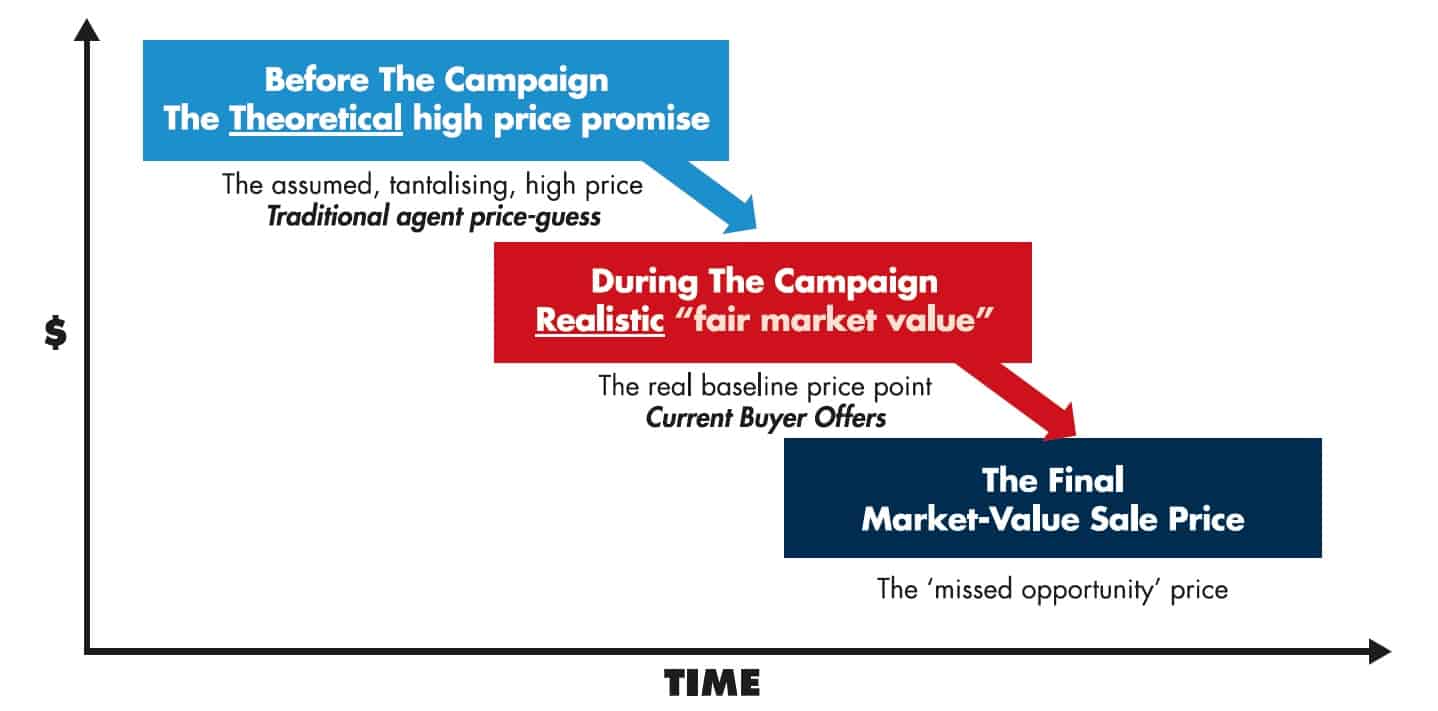

THIS IS HOW YOU WILL INCREASE YOUR CHANCE OF MISSING AN EMOTIONAL SALES PRICE

It’s the ‘overpromise-underdeliver’ approach … the most dangerous process in a flat or declining market.

Unfortunately, it’s also the most commonly used process in real estate.

THIS IS HOW YOU WILL INCREASE YOUR CHANCE OF SECURING AN EMOTIONAL SALES PRICE

It’s harder to find an above-market emotional price if you don’t know the market-based unemotional value of your home. It’s like starting from where you want to finish.

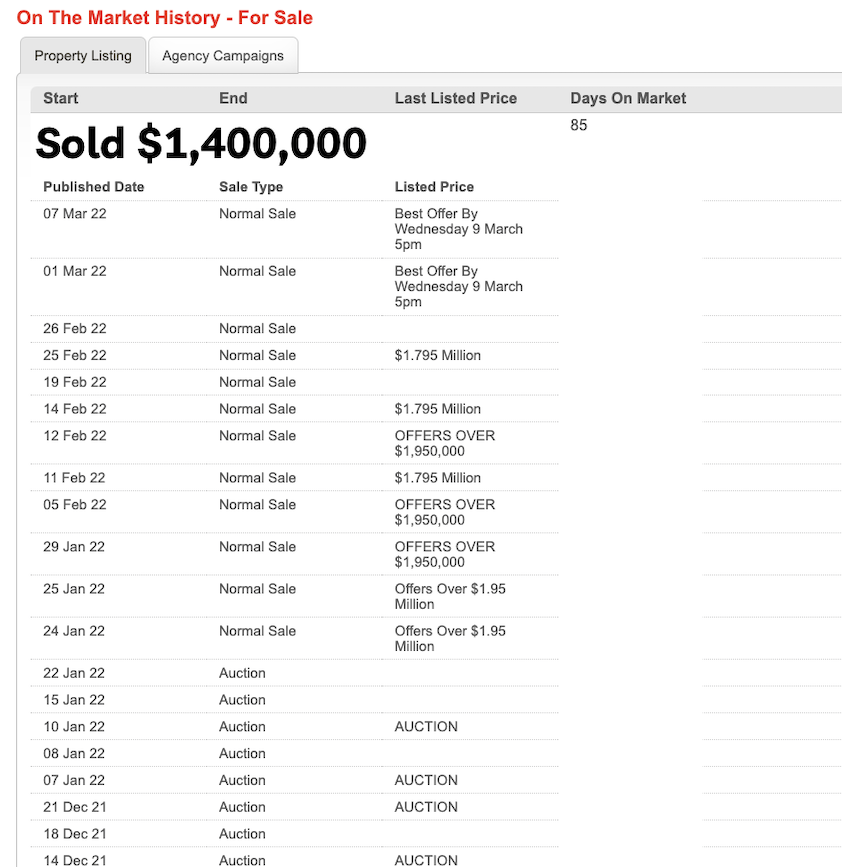

THIS IS WHAT A FAILED SALES CAMPAIGN LOOKS LIKE.

This is actually the anatomy of a failed ‘elite agent’ campaign. This is what it looked like behind the scenes … and this was when the market was booming!

Promise high, fail at auction, languish on the market, reduce, reduce, reduce price, end low.

This one was obviously promised a sale price of above $2M … and after languishing for 85 days on the market, it sold for $1.4M.

When promises and expectations are out of sync with the market, time and money is lost.

This is the golden rule of real estate in any market.

HOW TO WORK OUT THE UNEMOTIONAL PRICE RANGE OF YOUR HOME

1. You need to think like a buyer, NOT a seller. Sellers cherry pick ‘similar homes’ to find their market value and often miss recent sales that offer buyers far more for their money than the seller’s home does. To get a better understanding of your home’s value, you need to understand the value that buyers place on houses, not the value sellers place on houses, not the value agents place on houses, and definitely not the value valuers place on houses.

2. Buyers search for properties based on their budget. The buyer mindset is “I have $1,000,000 (for example), what does $1,000,000 buy me in this suburb?”. The key question to ask and understand is, “Do the recent sales near my home offer buyers less, similar, or more for their money than my home offers?”. Given that every buyer has access to the same online sales data that every seller has, you need to place yourself in your buyer’s shoes. When you do this, it is easily the best way to get a crystal clear picture of the unemotional price range of your home.

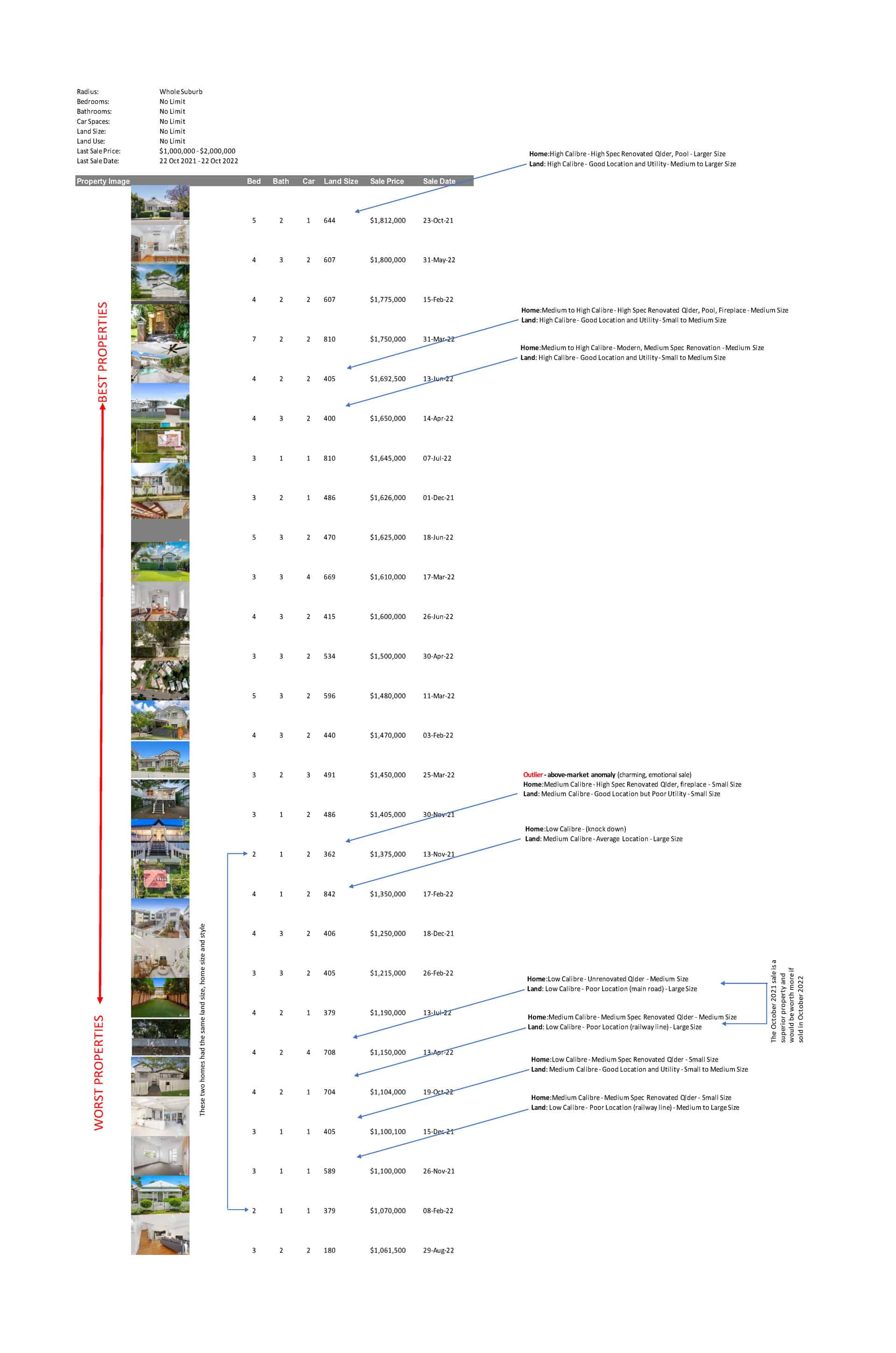

3. To understand what buyers can get for their money in the current market, you need to first of all construct a ‘Price Range Value Spectrum’, instead of just using a handful of your favourite ‘comparable sales’. Using a small selection of highly-biased comparable sales places your entire sales campaign at risk. One sale does NOT make a market. Isolated sales will mislead you, and more often than not, it will mean that your sales expectations will be completely out-of-sync with the market place, which always leads to sellers missing the highest price in the campaign. Constructing a ‘Price Range Value Spectrum’ (which is just a large list of recent sales sorted from the highest price to the lowest price) is the ideal way to capture ALL of the relevant past sales and makes it far easier to accurately assess what most buyers think about all of the property sales in your area.

4. Start with a value of what you believe your home is approximately worth (using anything from your own market research to even an automated online valuation) and construct a list of sold properties much higher and much lower in price than your home’s estimated value. Start with sales from just your own suburb and use the recent sales within the last 6-12 months within a radius of 500m to 1km from your home to begin with. Then place them in order from the highest price to the lowest price.

5. To construct your list of sold properties simply go to www.realestate.com.au, select your suburb, open the ‘filters’ tab and select ‘sold’, followed by your minimum and maximum price range, and then select the ‘sold date’ of ’last 12 months’. Now click the search button to generate your list of properties. You can now sort these sold properties from highest to lowest price and even view them on a map by clicking on the ‘map’ icon just above the list.

6. Identify sold properties that clearly offer buyers more for their money, and also less for their money, in comparison to your home, so that you can start to refine and close in on the approximate unemotional price range of your home.

It’s important to note that the value of any residential home is generally calculated based on the size and quality of the land combined with the size and quality of the home.

What you will often discover by constructing a ‘Value Spectrum’ are those isolated properties that have been under-sold, and those that have been over-sold. This will help you to ignore these one-off/anomaly sales and focus on what the bulk of the data tells you.

You may also notice that land size is often not the primary driver of overall value (see example Value Spectrum below). This can easily be seen by looking up and down your Price Range Value Spectrum where there are often homes on smaller lots at the top of the price range and often homes on larger lots at the bottom of the price range. The calibre of your home is often a major driver of your property’s overall value. New homes, trump renovated homes, trump dated homes with respect to value.

Unfortunately, understanding the difference between your home and other low, medium or high quality properties in your area is not always obvious.

If this is where you find yourself then this may be where you need the second opinion, or the tried and tested experience, of a real estate agent with a verifiable track record of accurate and/or honest price assessment.

However, if you end up requesting assistance from an agent who leaves the assessment of your home’s market value completely in the hands of the market place once your home has been listed, or you request assistance from an agent who does not have the educational skills to find your pre-campaign, unemotional price position, then you risk placing your biggest asset in a position of great jeopardy … and no one can afford to lose time and/or money when it comes to selling their biggest asset.

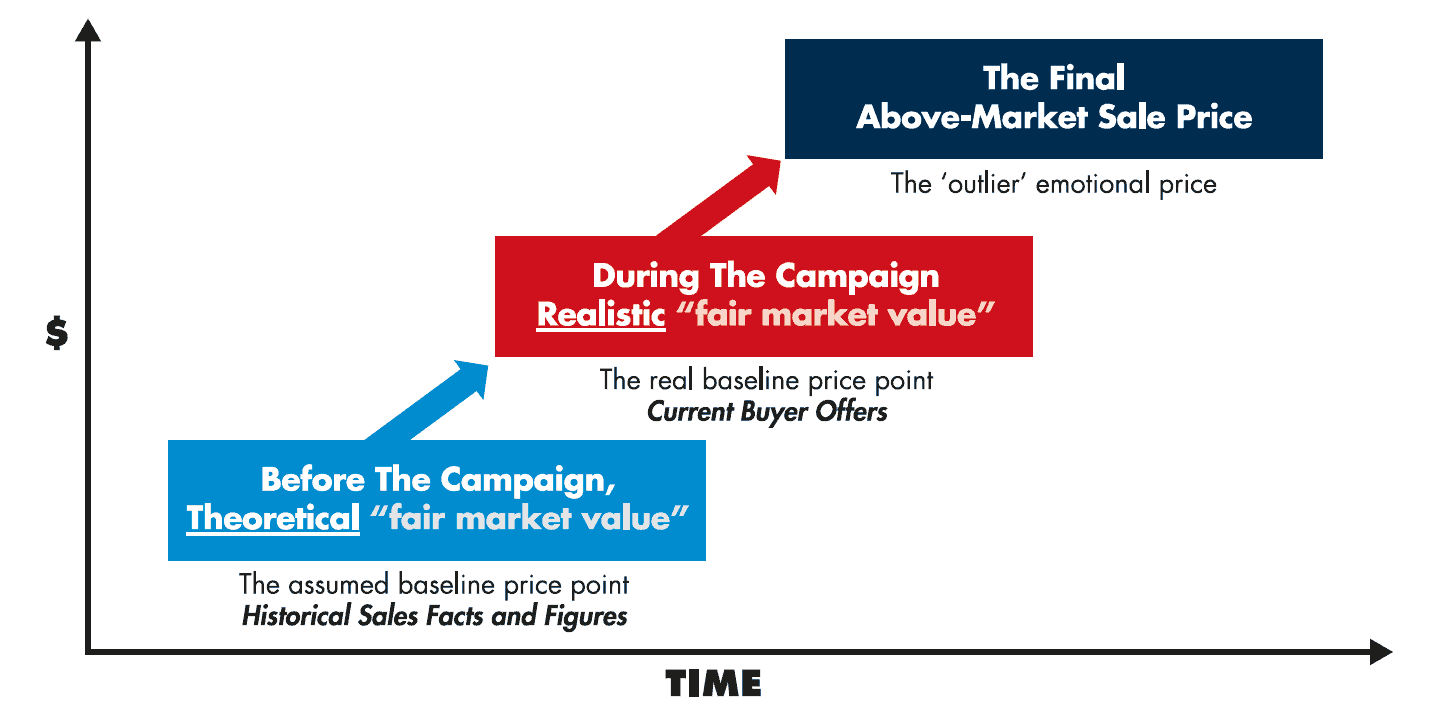

WARNING: It is critically important to understand that ANY pre-market price analysis is 100% theoretical. The only way to accurately assess your market value is within the marketing campaign itself. However, having a realistic understanding of what buyers can get for their money will almost always mean you will immediately be able to identify the real market value of your home, which means you will immediately be able to identify ‘a good, above-market deal’ when you see it.

AN EXAMPLE PRICE RANGE ‘VALUE SPECTRUM’

"Overwhelmed? Relax! If your home is in Brisbane or the Gold Coast contact us now if you would like us to help you put together a Price Range Value Spectrum"

To make sure you are prepped and ready for market, download our books here – Price Truths and Negotiation Truths

Or

Contact us for a no obligation Presentation AND Price Appraisal here